BBC

BBC

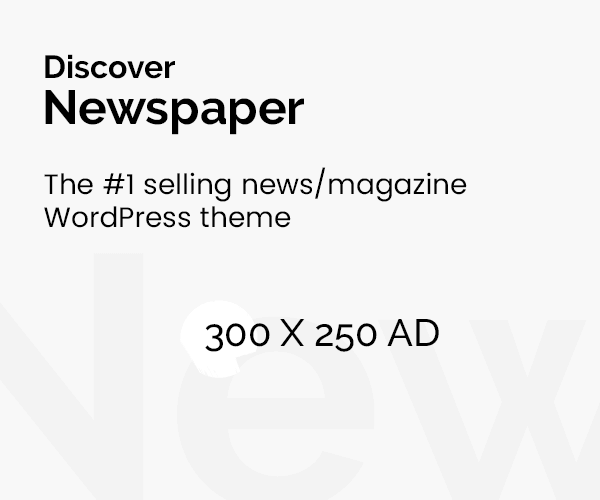

Prices in the UK rose by 2.6% in the 12 months to March, less than in the previous month but still above the Bank of England’s target.

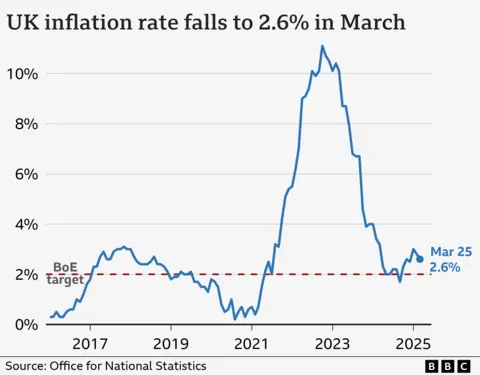

The Bank of England moves interest rates up and down to try to keep inflation at 2%, and has cut rates twice in 2025, taking rates to 4.25%.

The Bank previously warned that it expected inflation to rise again in 2025.

What is inflation?

Inflation is the increase in the price of something over time.

For example, if a bottle of milk costs £1 but is £1.05 a year later, then annual milk inflation is 5%.

How is the UK’s inflation rate measured?

The prices of hundreds of everyday items, including food and fuel, are tracked by the Office for National Statistics (ONS).

This virtual “basket of goods” is regularly updated to reflect shopping trends, with virtual reality headsets and yoga mats added in 2025, and local newspaper adverts removed.

It was a bigger drop than analysts had expected, which the ONS said was driven by a fall in clothing and shoe prices.

The Bank also considers other measures such as “core inflation” when deciding whether and how to change rates.

Core CPI doesn’t include food or energy prices because they tend to be very volatile, so can be a better indication of longer term trends.

This was 3.4% in March, down slightly from 3.5% in February.

Why are prices still rising?

Inflation has fallen significantly since hitting 11.1% in October 2022, which was the highest rate for 40 years.

However, that doesn’t mean prices are falling – just that they are rising less quickly.

Inflation soared in 2022 because oil and gas were in greater demand after the Covid pandemic, and energy prices surged again when Russia invaded Ukraine.

It then remained well above the 2% target partly because of higher food prices.

Why does putting up interest rates help to lower inflation?

When inflation was well above its 2% target, the Bank of England increased interest rates to 5.25%, a 16-year high.

The idea is that if you make borrowing more expensive, people have less money to spend. People may also be encouraged to save more.

In turn, this reduces demand for goods and slows price rises.

But it is a balancing act – increasing borrowing costs risks harming the economy.

For example, homeowners face higher mortgage repayments, which can outweigh better savings deals.

Businesses also borrow less, making them less likely to create jobs. Some may cut staff and reduce investment.

What is happening to UK interest rates and will they go down again?

The Bank of England cut rates in August and November 2024, and again in February and May 2025, taking rates to 4.25%.

Bank of England governor Andrew Bailey said the May decision was a result of inflation dropping back, and indicated that further “gradual and careful” cuts could follow.

However he warned that the introduction of US tariffs has shown “how unpredictable the global economy can be”. The Bank said it expected the tariffs to slow the UK economy and lead to lower inflation than expected.

The Bank previously said it expected inflation to spike at 3.7% between July and September 2025 before dropping back towards the end of 2027.

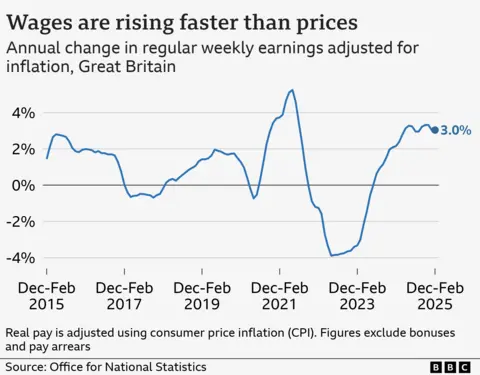

Are wages keeping up with inflation?

What is happening to inflation and interest rates in Europe and the US?

The US and EU countries have also been trying to limit price increases.

The inflation rate for countries using the euro was 2.2% in April 2025, the same as in March and down slightly from 2.3% in February.

In June 2024, the European Central Bank (ECB) cut its main interest rate from an all-time high of 4% to 3.75%, the first fall in five years.

It has since cut rates a further five times, taking its key rate to 2.5%.

Inflation in the US fell to 2.4% in March, which was down from 2.8% the previous month but still above the US central bank’s 2% target.

After a string of cuts in the latter part of 2024, the US central bank again chose to hold rates at its May meeting, citing the uncertainty generated by the US tariffs.

That leaves its key interest rate unchanged in a range of 4.25% to 4.5%.

The Federal Reserve has repeatedly come under attack from President Trump, who wants to see further cuts.